If I ask you - How many of you know Pidilite company?

Some of you might not have heard about it.

But, how many of you know Fevicol, Fevikwik, and Fevistick?

I guess every one of you would have heard about these names. Do you know that if you had invested Rs 1 lakh in Pidilite 10 years ago, what would be your investment value? Your 1 lakh of investment would be worth Rs 10 lakh! That’s 10 times return in 10 years!

So in this article, we are going to do the fundamental analysis of the parent company of Fevicol i.e. Pidilite, and see if it is worth investing in Pidilite or not. But before we proceed further, this series on stock fundamental analysis is only for long term investors and those who want to learn how to analyze stocks before investment. If you are a trader or looking for short term investment to make quick profit, then you can skip this article.

- Started in 1959 with Fevicol, Pidilite is the no 1 adhesive manufacturing company in India. As of today, Pidilite has a market cap of ~Rs 81,000 Crore.

- Pidilite brands Fevicol, Fevikwik, and Fevistick are so popular that people do not say that "give me an adhesive". They say that "give me Fevicol". People don’t say that "give me glue stick". They say that "give me Fevistick or Fevikwik". Just imagine the power of such branding. Pidilite brands are synonym of the entire product category.

- Just like people use Volvo for luxury bus and Maggie for noodles but in reality, Volvo is just a brand in a luxury bus and likewise, Maggie is a brand in the noodle category. This kind of branding is only possible when the products are top class and the market leader with strong dominance. Pidilite brands enjoy this dominance in their product category.

Company and its management- Mr. Madhukar B. Parekh is the CHairman of Pidilite.

- His journey with Pidilite commenced in 1972.

- Mr. Parekh’s four decade long journey has converted an ‘unexciting’ product into one of the country’s top brands – Fevicol.

- Other key brands ‘Fevikwik’, ‘Dr. Fixit’ and ‘M-seal’ are market leaders with high shares in their respective segments.

- He not only steered the company to become the market leader in the adhesives and sealants segment in India, but has also taken the legacy overseas, towards making Pidilite a true Indian MNC.

- Under his guidance, Pidilite has acquired several companies to enter international markets and enhance its product portfolio and market presence.

- Continuing the focus on product and brand innovation, under his leadership, Pidilite has clearly differentiated itself from the competition in this otherwise generic market.

Product CategoryThe Company operates under two major business segments i.e. Branded Consumer & Bazaar and Business to Business.

Products, such as Adhesives, Sealants, Art & Craft Materials and Others, Construction and Paint Chemicals are covered under Branded Consumer & Bazaar segment. These products are widely used by carpenters, painters, plumbers, mechanics, households, students, offices, etc. Business to Business segment covers products, such as Industrial Adhesives, Industrial Resins, Construction Chemicals (Projects), Organic Pigments, Pigment Preparations, etc. and caters to various industries like packaging, joineries, textiles, paints, printing inks, paper, leather, etc.

As of 2019-20, Consumer & Bazaar contributed 79.9% in overall sales of the company. Within this, the adhesive and sealant category contributed 52.6%, construction and paint chemicals contributed 19.2% and art and craft material contributed 8.1%. B2B segment contributed 18.7% where industrial adhesive contributed 6.1% in overall sales, industrial resin and construction chemical contributed 6.4% and pigment & preparation contributed 6.2% in overall sales.

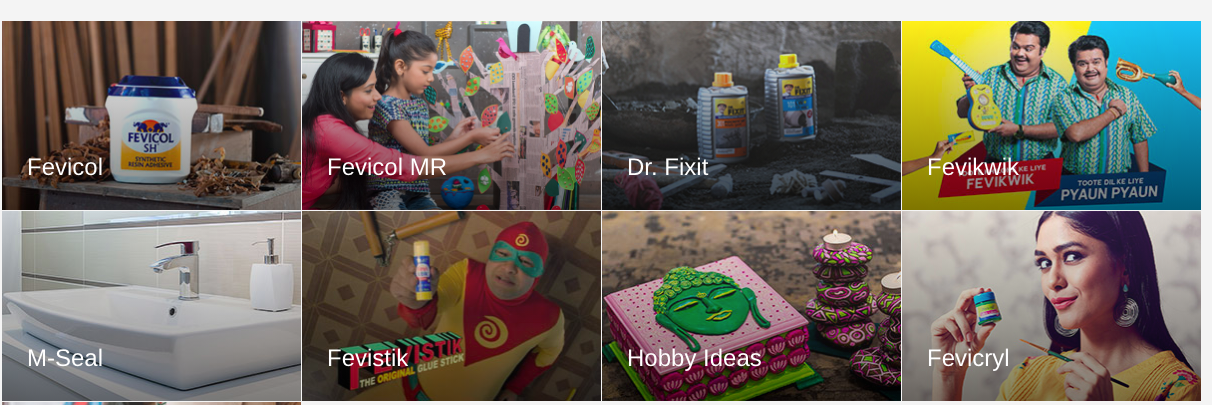

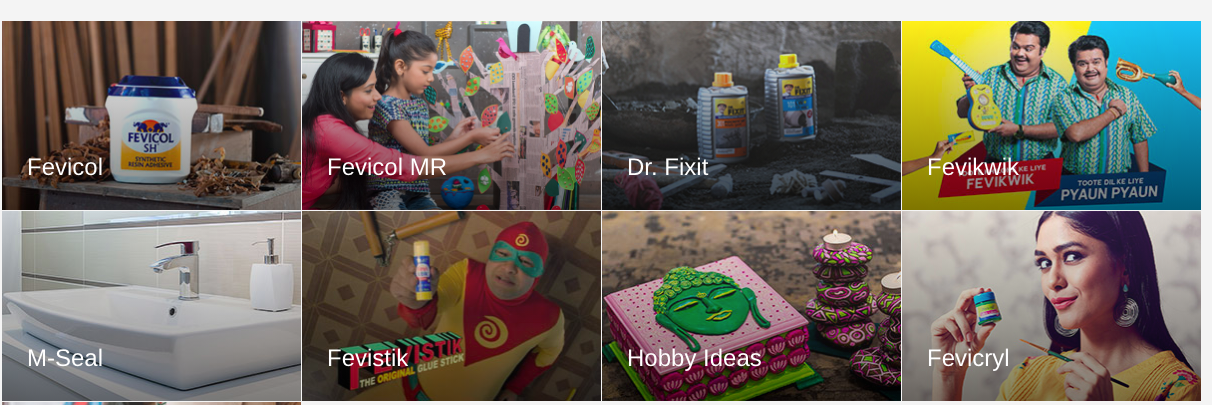

Brands and new product offering:

Brands and new product offering:- Fevicol : It is the #1 adhesive brand in India extensively used in furniture.

- Fevicol MR: Adhemsive for craft purpose.

- Dr Fixit: Waterproofing solution

- Fevikwik: One drop instand adhesive

- M-Seal: For sealing, joining and Fixing

- Fevistick: It is a gluestick.

- Hobby ideas: It include colring books, DIY kits, art and craft tools, etc.

- Fevicryl: It include fabric glue, acrylic color, 3d outliner, etc.

Company and its management Score: 10/10

Competitive Advantage- Brand Value: Pidilite brands like Fevicol, Feviqwik, Fevistick are no 1 in their category. The dominance is such that people do not recall any other brand. For example, in FMCG you have many competitors like HUL, ITC, Marico, Dabur, Britannia, etc. In banking you have many competitors like HDFC, ICICI, Kotak, Axis, etc. But I don’t see any name in adhesive and sealant category apart from Pidilite. Such is the dominance of this company. Innovative marketing.

- Extensive Research: Pidilite spend a good among of money on R&D to come up with new products. It has three fully-equipped in-house R&D centres in India and five state-of-the-art technical research and innovation centres in Singapore, Thailand, Brazil, Dubai and USA.

- New product launches: Pidilite keep launching new products to tap the emerging area. For example, Pidilite has launched many products in art and craft category, industrial manufacturing, etc.

- International Exposure: The Company’s major international subsidiaries are in Bangladesh, Sri Lanka, USA, Brazil, Thailand, Egypt and Dubai. So the company is growing all over the world and there is huge scope for growth in countries like Bangladesh.

- Strong relationship with local workers: Pidilite has created a strong relationship with carpenters, plumbers and distributors, who have been sustained and nurtured for generations.

Competitive advantage Score: 10/10

Future Prospect

- Increasing Demand from the Packaging Industry: The demand for adhesives in the packaging industry is increasing with a higher number of end-user applications. The packaging applications that use adhesives and sealants include flexible packaging, specialty packaging, composite containers, and frozen food packaging.

- India is the second-largest producer of food in the world, and one of the major consumers of packaged foods and beverages. As per the Packaging Industry Association of India (PIAI), the Indian packaging industry is currently the 5th largest sector of India's economy and is having a growth rate of 22-25% per year.

- Urbanization: With many people moving from small towns to cities, there is huge scope for growth in the construction segment which eventually is going to drive the growth in adhesive and sealant for use in furniture and waterproofing solutions.

- Increasing use of adhesives in new sectors: From nuts and bolts, the automobile industry is moving toward adhesives. Also, instead of sutures and stitches, the medical industry is moving toward adhesives. Such developments are opening up large markets for adhesive/sealant players.

Future growth prospects score: 10/10Let us look at the financials of Pidilite:1. Growth Ratio:

Over the past 10 years, Pidilite revenue has grown from Rs 2657 Cr. to 7294 Cr. That's a CAGR growth of 13%.

Over the past 10 years, Pidilite revenue has grown from Rs 2657 Cr. to 7294 Cr. That's a CAGR growth of 13%.

Over the past 10 years, Pidilite profits have grown from Rs 310 Cr. to 1116 Cr. That's a CAGR growth of 16%. That's a fantastic performance. Both revenue and profit growth has been consistent over the past 10 years.

Growth ratio score: 10/10

2) Profitability Ratio

Operating profit has been very good!

Operating profit has been very good!

Both ROE and ROCE are well above 20% which shows that Pidilite is very profitable.

Profitability Ratio Score: 10/10

3) Leverage Ratio

Debt to equity has been 0.06 which shows that Pidilite is a debt free company.

Debt to equity has been 0.06 which shows that Pidilite is a debt free company.

Leverage Ratio Score: 10/10

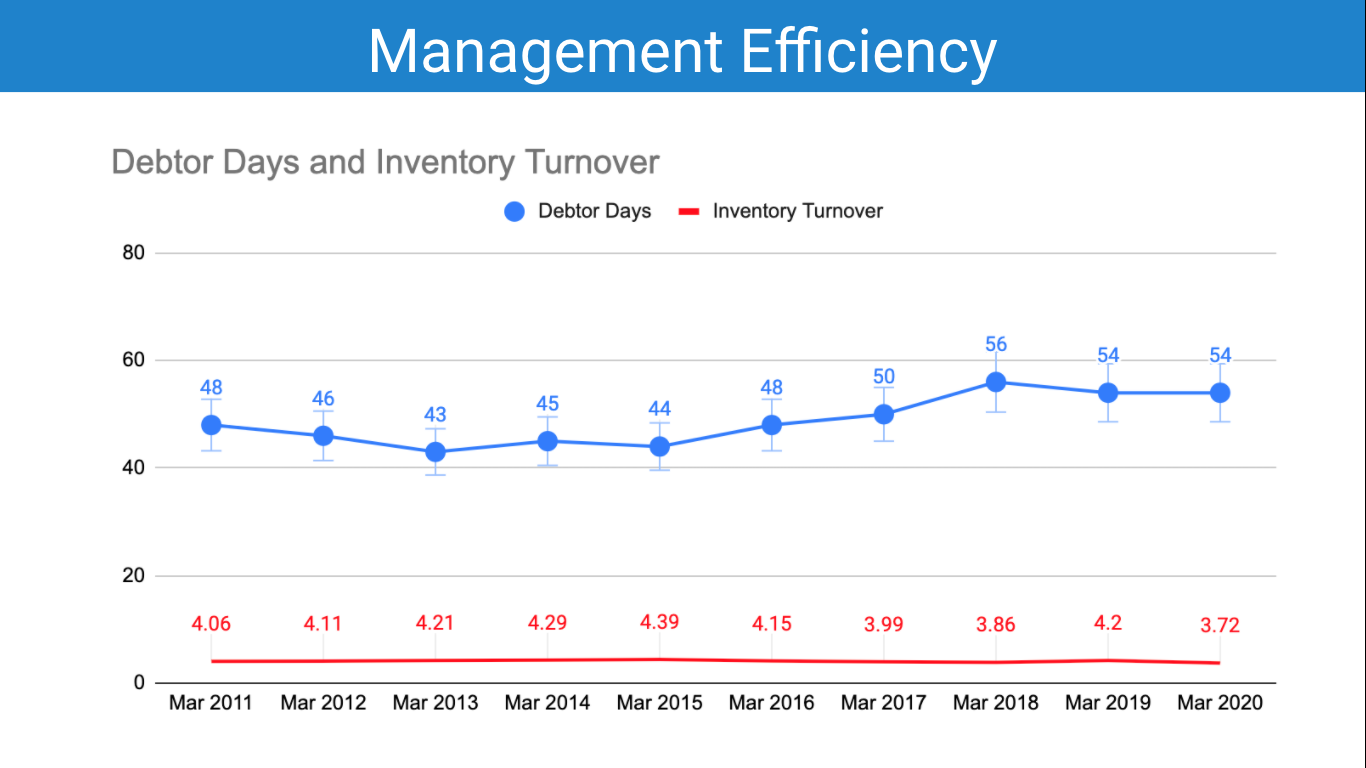

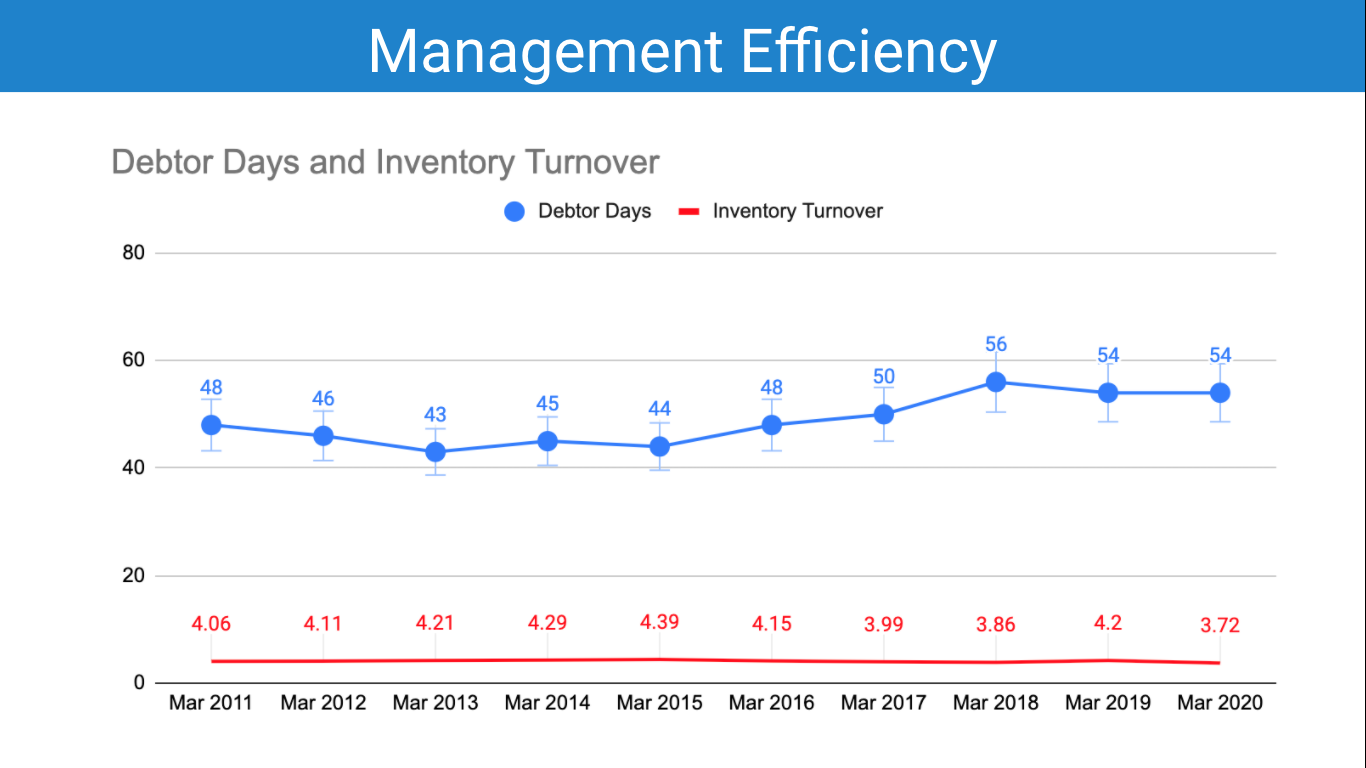

4) Management Efficiency

Both debtor's day and inventory turnover are consistent over the last 10 years. Although, debtor's day has slightly increased in the last few years.

Pidilite reserves are increasing every year. The current reserves are Rs 4405 Cr.

Management Efficiency Score: 9/10

Pidilite promoters have a high shareholding of 70% in the company. It shows the confidence of the promoters in the company.

Valuation Analysis

Let us look at the share price movement of Pidilite:

In the last 15 years, Pidilite share price has jumped from Rs 21 to Rs 1560. That's ~75 times return. Pidilite has been a true multibagger!

The median PE of Pidilite in the last 3 years is 61 and the current PE is 88. At first look, Pidilite share looks overvalued. But if we look at the details, the high PE is mainly due to poor earnings in Mar 2020 and June 2020 quarters. This was due to a nationwide lockdown due to COVID. Due to low earnings, the PE ratio has increased. But the economic situation is improving and the earnings are increasing. September 2020 quarter has shown significant growth. This means that in the future as the earnings improve, the PE ratio will fall.

Hence, overall looking at the valuations, I would say that Pidilite is a fairly valued company.

Valuation Score: 7/10

Conclusion: Pidilite is a fundamentally superstrong company with a score of 69 out of 70 and available at a fair valuation. It is a must-have stock in the portfolio of every long term investor.

PS: If you want to learn every aspect of fundamental analysis of stock and other important concepts of personal finance, you can explore my video course on "everything about money management".

Brands and new product offering:

Brands and new product offering:

Over the past 10 years, Pidilite revenue has grown from Rs 2657 Cr. to 7294 Cr. That's a CAGR growth of 13%.

Over the past 10 years, Pidilite revenue has grown from Rs 2657 Cr. to 7294 Cr. That's a CAGR growth of 13%.

Operating profit has been very good!

Operating profit has been very good!

Debt to equity has been 0.06 which shows that Pidilite is a debt free company.

Debt to equity has been 0.06 which shows that Pidilite is a debt free company.