Generally, when we invest in the stock market, we tend to invest in companies we can relate with. For example, in the automobile sector, the focus would be on companies like Maruti, Bajaj Auto, Eicher Motor, Tata Motor, Ashok Leyland, etc.

But, there are many companies which operate in B2B segment and generally as retail investors we do not pay much attention to such companies. In this video, we are going to investigate one such company.

This company is one of the world’s largest manufacturers of automobile components. In fact, its products are used in cars like Audi, BMW and Mercedes. It's a proud Indian company. The company name is Motherson Sumi.

In the article, we are going to explore whether Motherson Sumi is a fundamentally strong company or not. For this, we will explore its business, competitive strength, its future growth prospects and finally its financials. Then we will look at the valuations of the company to understand if it is worth investing in Motherson sumi at current levels or not.

So let’s get started!

Company and its Management

- The foundation of Motherson sumi was laid down in 1975 by Mr Vivek Sehgal and his late mother. It was initially started as a silver trading company. As it was a Mother and Son duo, Mr Vivek Sehgal’s father suggested the name “mother-son”. Mr Sehgal immediately liked the name as it signified trust. That’s how it got the name Motherson.

- In 1983, when Maruti Suzuki announced the assembly in India, Motherson Sumi was among the few companies with Indian-made parts. It was a proud moment for the company.

- Later, in 1986, Motherson had a joint venture with a Japanese company named Sumitomo Wiring System and the company was renamed to Motherson Sumi.

- Motherson Sumi has been ranked No. 1 auto ancillary in India for seven consecutive years by Fortune India 500.

- Between the year 1993 and 2020, the revenue of Motherson Sumi has grown from Rs 19 Cr to Rs 67,400 Cr. That’s a growth of 3,492 times in 27 years!

- As of today, the company has a market cap of Rs ~ 50,000 Cr.

Business: - Wiring Harness: It is an assembly of electrical cables or wires which transmit signals or electrical power. They have usage across industries but the automobile sector is the largest consumer. It helps in connecting various devices within the car and transfer electricity & signals.

- Modules & Polymer Products: MSSL is one of the world’s largest manufacturers of interior and exterior components from simple plastic parts to highly integrated modules for all types of vehicles. Interior products include door panel, airbag box, cockpits, etc. and exterior products include bumper, door handle, head lamp, rear lamp, etc.

- Vision System: MSSL is world’s leading supplier of rearview mirror systems for passenger cars and light commercial vehicles and is a pioneer in camera systems with high-performance image processing technology for automotive applications.

- Metal Products: This division offers an array of products like cutting and gear cutting tools, shock absorbers, clutches for car, AC compressors, etc.

Breakup by geography and customer:

Overall, on the company and its product portfolio,

I would rate it 10/10.

Competitive Strength

- Experienced Management: Motherson Sumi has got very experienced leadership. Mr Vivek Sehgal ,who started this company in 1983, is still leading the company as the chairman and CEO of the company.

- Strong R&D Capability: Company focuses a lot on its R&D capability to come up with cost efficient and innovative products.

- Diverse Business Segment: Thanks to its organic and inorganic growth, MSSL which started its journey from wire harnessing, is now into various other categories like modules and polymer, vision system, metal products, etc.

- Strong geographical presence: Motherson Sumi has its presence in 41 countries all over the world. So it is not dependent upon a single country for the business.

- Diverse Customer Base: Its customers include the top car manufacturing companies like AUDI, Mercedes, BMW, etc. Again, there is no dependency on a single customer.

Overall, looking at the competitive strength,

I would rate it 10/10.

Future Growth Prospects

In the short term, Covid has badly impacted the revenues of the company for 1st and 2nd quarter of FY20. However, the company said that now around 80% of its facilities are running at over 75 per cent capacity, indicating that things have come back to near normal. Although, Covid is not over yet. So there is high uncertainty in the short term.

- The company has set a target of achieving $36 billion in revenue by FY25. Please note that the FY20 revenue was ~$8.7B. It means the company is targeting a revenue of almost 4 times in the next 5 years. That’s a very ambitious target. In order to achieve the target, the company is planning to grow both organically and inorganically via acquisitions.

- Interestingly, Motherson sumi is targeting 25% contribution from non-automotive businesses. So far, Motherson Sumi major business is from automotive business, but it is planning to expand its customers across businesses like logistics, aerospace and healthcare.

- Company is targeting a ROCE of 40% by 2025 and reducing the business risk via 3CX10. It means no more than 10% of the company’s revenue should come from a single customer, single country or single component. Basically, the company does not want to over depend upon any customer, country or component for its major revenue.

What I personally like about Motherson Sumi is its bold vision of growth. It has been publishing its 5 year vision since 1995. The company says that “Without our 5-year plans, we would probably have continued to grow at around 10-20% a year. This would have been handsome. It would have made us a US$ 270 million company in 2020. In reality, we are a US$ 8.9 billion company today.”

The company chairman Mr Seghal mentioned in the annual report that the company couldn’t close several acquisitions due to COVID19. However, there is a possibility that the economic circumstances created by the pandemic make the available opportunities more attractive”.

Overall, looking at the future growth prospects, I would rate it 10/10.

Financials:

1) Growth Ratio:

Over the past 10 years, Motherson Sumi revenues have growth at a CAGR of 25% and its profits have grown at a CAGR of 18%. That’s a phenomenal growth! Although, the profits have not grown much in the last few years, the major reason is new acquisitions which are yet to show the results. Hence, on growth ratio, I would rate it 10/10.

2) Profitability:

The reason for fall in profitability is due to Covid19, negative growth in auto industry all over the world and heavy acquisitions and investments that are yet to show results. But overall, Motherson Sumi has done very well and I would rate it 8/10.

3) Debt to equity:

For a business, some amount of debt is good. Normally, a debt to equity of less than 1 is preferred. Motherson sumi has taken this debt to fuel its growth by more acquisitions. Overall, on debt to equity, I would rate Motherson Sumi 7/10.

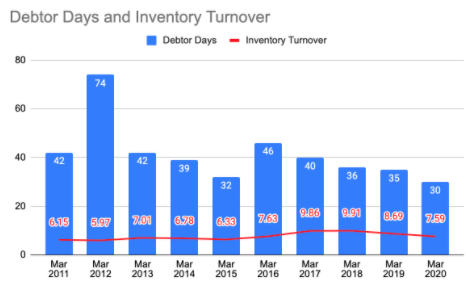

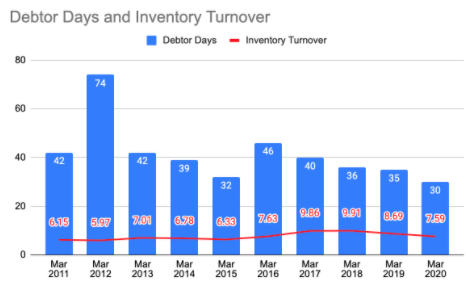

4) Management efficiency ratio:

Overall, on management efficiency, I would rate it 8/10.

Valuations:

Motherson Sumi touched a peak of 257 and from those levels, it is at the level of 160. The major reason for the fall in the share price was due to global negative growth in automotive industry which impacted its profitability as well as new acquisitions which are yet to give the returns.

Motherson Sumi touched a peak of 257 and from those levels, it is at the level of 160. The major reason for the fall in the share price was due to global negative growth in automotive industry which impacted its profitability as well as new acquisitions which are yet to give the returns.

Once the auto industry growth picks up, I think Motherson Sumi will benefit a lot from it. If it even comes close to its vision of 2025 then the company will reward its investors handsomely. Hence, on valuations,

I would rate it 8/10.

Conclusion: Overall, looking at the highly experienced management, diverse product base and global footprints, Motherson Sumi is a fundamentally superstrong company currently trading at decent valuations and has bright future prospects.

PS: If you want to learn every aspect of fundamental analysis of stock and other important concepts of personal finance, you can explore my video course on "everything about money management".

Disclaimer: This article is only for education purpose. Consult your financial Advisor before investing your money.

Motherson Sumi touched a peak of 257 and from those levels, it is at the level of 160. The major reason for the fall in the share price was due to global negative growth in automotive industry which impacted its profitability as well as new acquisitions which are yet to give the returns.

Motherson Sumi touched a peak of 257 and from those levels, it is at the level of 160. The major reason for the fall in the share price was due to global negative growth in automotive industry which impacted its profitability as well as new acquisitions which are yet to give the returns.